Stripe, the dominant player in the fintech space with a valuation of $65 billion and a staggering $1 trillion in processed payment volume last year, is making significant changes to its approach amidst growing competition.

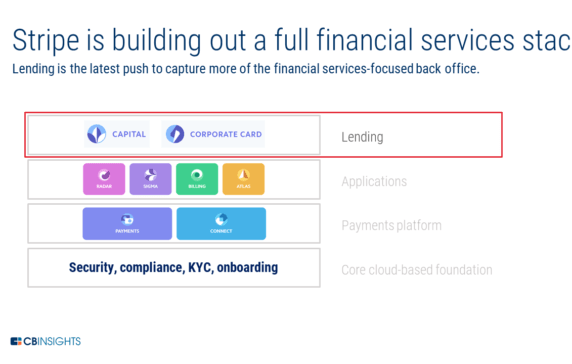

Today, Stripe announced a major shift by separating its payments service, its flagship offering, from the rest of its financial services stack. This marks a departure from its previous strategy, where businesses were required to use Stripe’s payment services to access its other tools. In addition to this change, the company is introducing a range of new embedded finance features and AI tools.

The announcement came during Sessions, Stripe’s developer event in San Francisco, where the company unveiled more than 50 new features as part of its platform, totaling over 250 announced this year.

While the sheer number of new features may seem overwhelming, most of them are incremental updates to existing products. Patrick Collison, CEO and co-founder of Stripe, emphasized the company’s mission to grow the GDP of the internet and its strategy of listening to the needs of innovative businesses worldwide.

Decoupling its payments API addresses a significant barrier for customers who were interested in using Stripe’s other services but didn’t want to commit to its entire platform. This move reflects a shift in how Stripe views its platform, now exploring selling non-payments services independently.

Will Gaybrick, Stripe’s chief product officer, acknowledged that users had long requested this change, but technical complexities delayed its implementation.

The move also reflects broader shifts in the market, where platforms like Stripe aim to capture larger revenues by offering comprehensive services. However, customers increasingly seek flexibility and may opt to work with multiple providers or use specific services as needed.

In addition to decoupling payments, Stripe announced several other updates, including AI-powered enhancements to checkout and fraud detection tools, expansion of its embedded finance offerings, and the introduction of usage-based billing capabilities. These updates underscore Stripe’s commitment to remaining competitive and meeting the evolving needs of its users in the rapidly changing fintech landscape.