The price of Ethereum (ETH) has dipped below two significant support levels following a consistent downward trend over the past week.

This bearish trend is anticipated to escalate in the upcoming days as ETH appears to be reaching a market top.

Ethereum Struggles to Maintain $3,000 Level

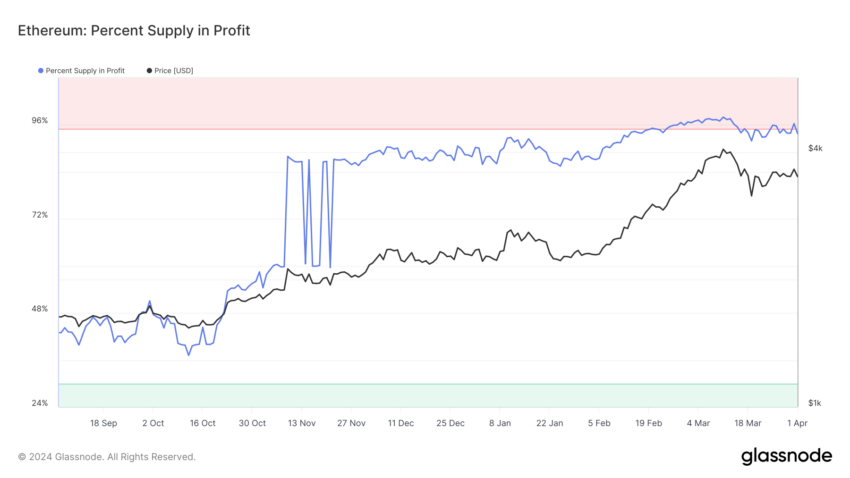

Despite a recent attempt to regain ground and nearly reaching $3,500 as a support base, Ethereum faltered, resulting in profit-taking among cryptocurrency investors. Currently, over 96% of the total supply is experiencing profits.

Such a scenario typically indicates a market top, representing the highest point in an asset’s price before a downward trend commences. This sentiment signals a peak in investor confidence and often heralds a market correction or downturn, especially when more than 95% of the supply is in profit. Therefore, the likelihood of further decline in ETH is considerable.

Moreover, Ethereum has seen a steady increase in selling pressure, with the supply on exchanges rising over the past few months. Investors have offloaded more than 2.31 million ETH, valued at over $7.6 billion, onto exchanges.

Consequently, if selling persists amid bearish conditions, Ethereum’s price may struggle to recover, resulting in further downward pressure.

Potential ETH Price Downturn: Heading Towards $3,000?

Currently trading at $3,308, Ethereum has breached both the 50 and 100-day Exponential Moving Averages (EMA) and fallen below the $3,336 support line. This leaves ETH susceptible to testing the next critical support level at $3,031.

A descent to this level seems probable, and under sustained unfavorable conditions, ETH could even drop below $3,000.

However, a potential rebound from the $3,031 mark could lead to a recovery or slowdown in the decline. This scenario would provide Ethereum with an opportunity to reclaim $3,336 and invalidate the prevailing bearish outlook.