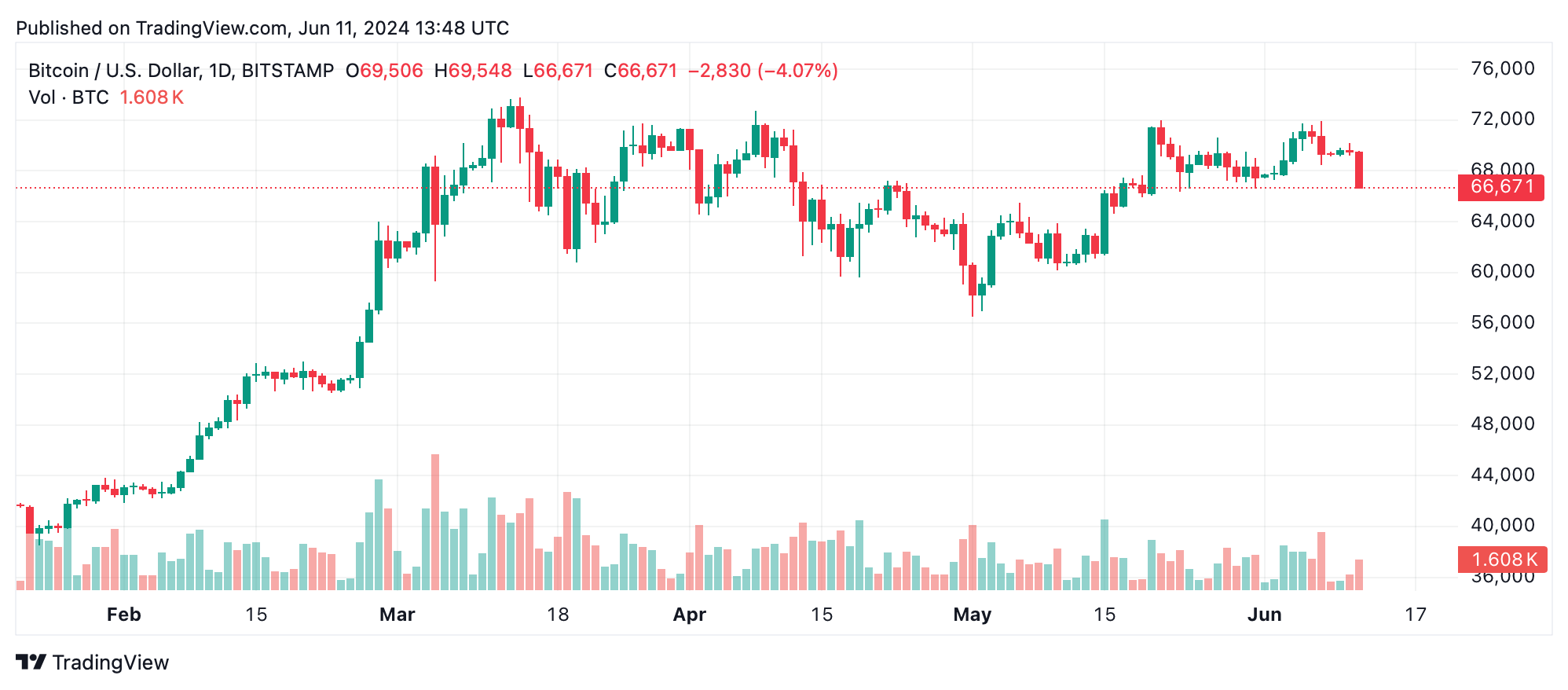

On Tuesday, Bitcoin (BTC) dropped to an intraday low of $66,696 per unit, marking a 3.3% decrease over the last 24 hours. This decline resulted in the liquidation of $170.25 million in long derivatives positions, with $50.87 million of this amount comprised of BTC long positions.

Bitcoin Shudders Below $67,000

The global cryptocurrency market now stands at $2.44 trillion, reflecting a 3.35% decline in the past 24 hours. Bitcoin fell to $66,696 after hovering above $69,000 for several days. Currently, the price is just below the $67,000 mark, down more than $2,200 in the last 24 hours. This drop led to the liquidation of 75,247 traders in the past day.

In total, $195.66 million in crypto derivative positions were liquidated, with $170.25 million from long positions. Of these, $50.87 million were Bitcoin (BTC) longs, $48.95 million were Ether (ETH) longs, and $6.5 million were Solana (SOL) longs. On June 11, the crypto firm QCP Capital highlighted several pressures affecting digital asset markets.

QCP pointed out that unexpected U.S. non-farm payroll (NFP) figures caused a spike in Treasury yields, leading to a reevaluation of expected interest rate cuts in July and September. In Europe, President Emmanuel Macron’s call for a snap election has increased geopolitical uncertainty, weakening the euro against the U.S. dollar and fostering a broader risk-off sentiment among investors.

Additionally, QCP Capital noted that market sentiment is cautious ahead of the upcoming Consumer Price Index (CPI) data and Federal Open Market Committee (FOMC) meeting, which will include the Dot Plot, indicating the Federal Reserve’s expected rate cuts through 2024. Moreover, there was a significant $64 million withdrawal from spot Bitcoin exchange-traded funds (ETFs) on Monday.