BlackRock has revised its roster of Authorized Participants for its Bitcoin ETF product, IBIT.

Among the new additions are ABN AMRO Clearing USA LLC, Citadel Securities LLC, Citigroup Global Markets, Inc., Goldman Sachs & Co. LLC, and UBS Securities LLC.

Authorized Participants play a pivotal role in ETFs, facilitating the creation of new shares for investors. Presently, the list of Authorized Participants for IBIT includes Jane Street Capital, JP Morgan, Macquarie Capital, and Virtu Americas.

The introduction of BlackRock’s spot Bitcoin ETF, alongside eight other funds, has been driving a substantial surge in Bitcoin prices, consequently impacting the broader crypto market. The inclusion of five major players from the financial sector suggests that the recent influx of capital from Wall Street into crypto assets will persist.

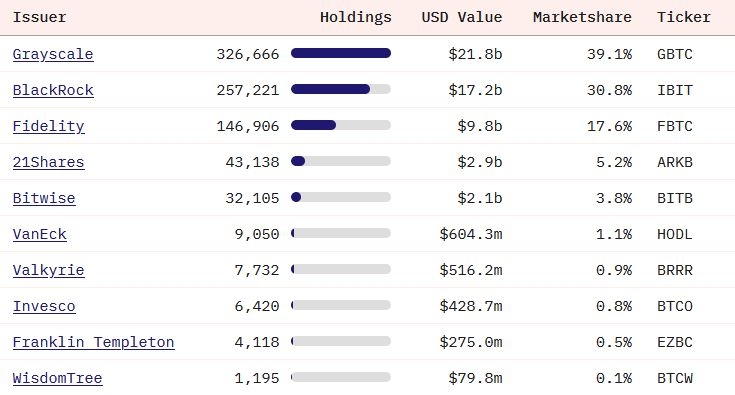

IBIT stands out as the most favored among the nine Bitcoin ETFs launched on January 11. Currently, it holds 257,221 BTC, equivalent to approximately $17.2 billion, on behalf of its clients, commanding a 30% market share for these assets. Fidelity follows closely behind, holding $9.8 billion in BTC for its customers, representing a 17% market share, as reported by a Dune dashboard.

UBS emerges as the largest among the new participants, boasting $3.1 trillion in assets under management (AUM).

Goldman Sachs reported $2.8 trillion in AUM in Q4 of 2023. Citigroup’s total AUM stands at $2.4 trillion, while Dutch firm ABN AMRO showcases $417 billion in total assets. Citadel, hailed as the most successful hedge fund in history, holds $92 billion in AUM.