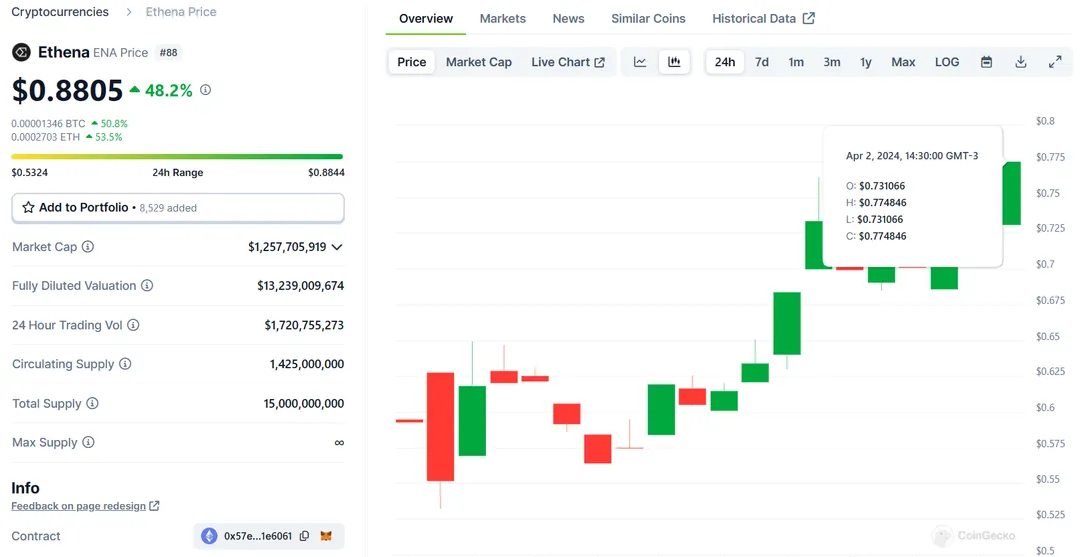

The ENA governance token from Ethena Labs, alongside USDe, has had a tumultuous journey, yet this hasn’t deterred substantial support from investors and traders.

Ethena Labs recently unveiled its governance token, $ENA, and expanded its yield-earning stablecoin, synthetic dollar token USDe. While this debut has sparked significant interest, receiving accolades from crypto enthusiasts like Arthur Hayes, the former CEO of BitMEX, it’s accompanied by a complex backstory.

Ethena aims to enhance decentralization, accessibility, and security using this new token. As part of its Season 2 campaign, the company distributed 5% of the total $ENA supply to all USDe and sUSDe holders over five months.

However, Ethena faced controversy when a February press release suggested it had secured millions from prominent investors who, as it turned out, weren’t involved. Ethena later clarified the error, attributing it to an “honest mistake.”

Despite skepticism and the perceived risks, including echoes of the Terra ecosystem collapse, investor interest in the coin remained high. Since its launch, ENA has amassed over $1.2 billion in total market capitalization, securing its position as the 80th most valuable cryptocurrency according to Coingecko.

Before diving into the ENA ecosystem, it’s crucial to grasp its operational intricacies. The protocol’s approach to minting, redeeming, and maintaining USDe’s stability is intricate, making it challenging for newcomers to navigate independently.

ENA serves as the governance token for Ethena, the DeFi protocol behind the USDe stablecoin. ENA holders wield decision-making rights akin to shareholders in a company.

The protocol hinges on minting and redeeming USDe, ensuring its stability against the US dollar amidst crypto market volatility. Ethena employs Ethereum and staked Ethereum as collateral, backing each USDe with tangible assets, albeit not traditional dollars in bank accounts, but cryptocurrencies locked in pools.

To mitigate risks associated with Ethereum’s fluctuating value, Ethena employs delta hedging—a strategy to hedge against potential market losses. This involves setting up derivatives contracts to counterbalance Ethereum price fluctuations, safeguarding USDe’s stability.

Ethena’s Off-Exchange Settlement (OES) mechanism allows asset management without reliance on exchanges, reducing hacking risks. While balancing centralization and decentralization, Ethena faces complexities in liquidity management and operational coordination across platforms.

Ethena’s expansion plans involve diversifying collateral types and broadening its presence across blockchain ecosystems, enhancing scalability but complicating the protocol’s comprehension.

For those intrigued by these dynamics, ENA is available for trading on various platforms, including Binance, Bybit, Kucoin, Gate.io, and HTX. It’s also accessible on decentralized exchanges and can be earned through staking on platforms like Binance Launchpool and Bitget Launchpool.